The financial model used in a reserve fund study is a key part of the study, and considers many factors: anticipated expenditures, the current reserve fund balance, the return on investments in the fund and anticipated inflation. The result of the analysis is the recommended contributions to the reserve fund to sustain the fund over the next 30+ years on a cashflow basis.

When it comes to planning reserve fund projects, a commonly held misconception is that deferring major projects will help reduce the required contributions to the reserve fund. This thinking holds true when there are short-term cashflow constraints on the fund (common for older condominiums facing significant renewal projects with underfunded reserves), or when real interest rates are positive (i.e. interest rates are higher than inflation rates). In this time of extremely low interest rates and high construction cost inflation rates, there can often be no financial gain from completing targeted repairs to defer replacement.

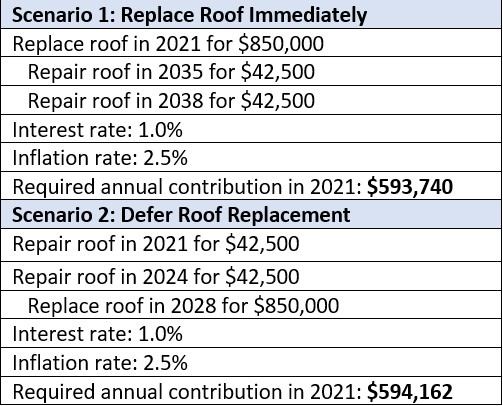

The examples below detail two repair strategies for a roof that requires replacement or major repairs. The first scenario shows the financial impacts of replacing a roof immediately (in 2021) vs. completing targeted repairs (in 2021 and 2025) to defer replacement (until 2028). For this illustrative example we assume the condominium has a healthy reserve fund balance within the timeframe presented, so large expenditures do not create any short-term cashflow issues. This is typically the case for newer buildings and older buildings that are well funded.

This comparative analysis uses an “all other things being equal” approach with the only change being the timing for roof replacement and whether or not repairs are required in the short term. Budgets shown are in 2021 nominal amounts. Each scenario uses the following assumptions:

As you can see from the results above, deferring roof replacement costs the condominium an additional $420 annually, whereas most would assume the reason to defer would be to save money, not spend more. Replacing the roof immediately would come with additional benefits of having a new roof including the comfort of knowing the roof is less prone to leakage and less potential for damage to interior finishes, a decrease in disruption to residents, reduced effort from the property manager to deal with leaks, etc.

The future is unpredictable, however that doesn’t mean that we cannot plan for it. Reserve fund planners must carefully consider key assumptions that factor into the financial analysis. We must understand that there are no one-size-fits-all solutions. Current interest rates for guaranteed investment certificates (GICs) and similar products are extremely low. Combined with high inflation rates for construction costs; real rates of return are expected to be negative for some time. Until real rates rise, the assumption that deferring major expenditures to save money is not always true.

About the authors

Steven Ekstein, P.Eng.

Steven Ekstein, P.Eng.

Steven is a professional engineer and a Project Associate with the Capital Planning team at Synergy Partners.

Stewart Handrahan, M.Eng., P.Eng.

Stewart Handrahan, M.Eng., P.Eng.

Stewart is a professional engineer and Project Manager with the Capital Planning team at Synergy Partners

Stay up to date by following us on social media.